What is FIAT Money

FIAT Money is a type of currency owned and controlled by the state and central banks that is NOT backed by a physical commodity such as gold or silver, but the trust in the government that issues it. The Pound, the Dollar, the Yen, the Euro are all FIAT currencies.

FIAT money has no intrinsic value, nor use value and is subjective based on the social construct that humans have to use it as a unit of account and means of exchange, they trust it will be accepted by other humans.

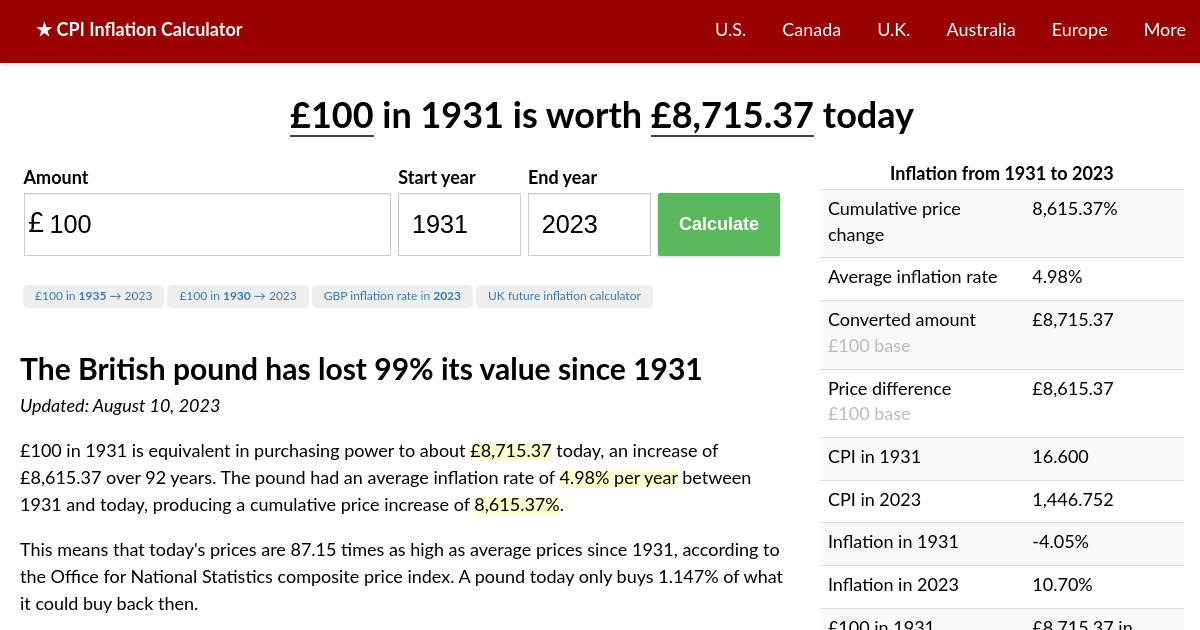

Governments and central banks can create more FIAT with the press of a button… and each time they press that button, the price of eggs increases which is known as inflation; and due to inflation (inflating the number of currency units in existence), in the UK around 2020 6 eggs cost 50p, now just 3 years later 6 eggs are nearly £5.

Inflation is a form of monetary abuse and theft from the normal hard working person, stolen after its been earned leaving us all with less purchasing power. It's not the first time an abuse of money has occurred, coin clipping and metal debasement has occurred many many times over the centuries by both the state and the people.

The state can debase currency, but when the people do (coin clipping) its a criminal act. BOTH are criminal acts.

It wasn’t always this way, money used to be backed by gold, in 1698 the master of the mint, Sir Isaac Newton, pegged the Great British Pound (the global reserve currency at the time) to the gold standard, and as gold only inflates approx 1.75% per year the price of goods and services until 1914 slowly increased accordingly, an apple for example was relatively the same price for 100 years. "As good as gold", as the saying goes.

The only other time in British history the pound was taken off the gold standard and onto a FIAT standard was for the revolutionary war in France in 1797 known as the Bank Restriction Act of 1797

British banknotes were overprinted by William Pitt the Younger and by the end of 1814 the banknotes had a total face value of £28.4m backed by only £2.2m in gold. Sir Robert Peel reversed this with £2.2m in notes backed by £11m in gold bullion.

According to the UK National Archives in 1914 John Maynard Keynes took the UK off the gold standard to fund WW1 by printing £400m having purchased (via two Bank of England clerks) 2/3rd's of the war bonds the British citizens refused to buy; as they didn’t want to give up their gold or go to war… WW1 lasted 4 years, it would have been over much faster, some believe a over weekend (which is why we have the August Bank Holiday in the UK) had Keynes not moved the UK onto the FIAT Standard - the Gold Standard was a renaissance for Great Britain, its now been a century of war and ever increasing prices of goods and services.

After WWII and due to the great expense of war, Great Britain lost control of the global reserve currency, the US quickly took over.

In 1946, the Bretton Woods agreement was formed and then in 1953 the US took over as the global reserve currency, initially backed by gold.

In 1971 Nixon removed the USD from the gold standard, and that’s where trouble really began.

Coming soon...What IS Money